27+ calculate dti for mortgage

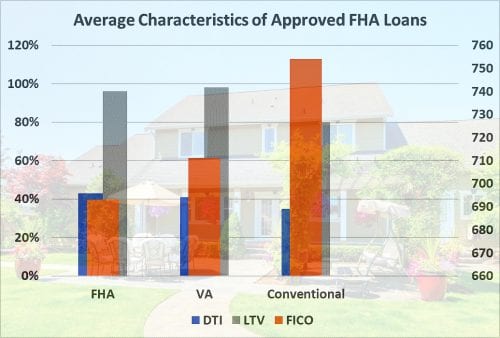

Web Debt-to-income ratio DTI is a comparison between your monthly debt payments and your gross monthly income. Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money.

How Much Home Can I Afford How To Calculate Your Dti Ratio Calculate Your Debt To Income Ratio Youtube

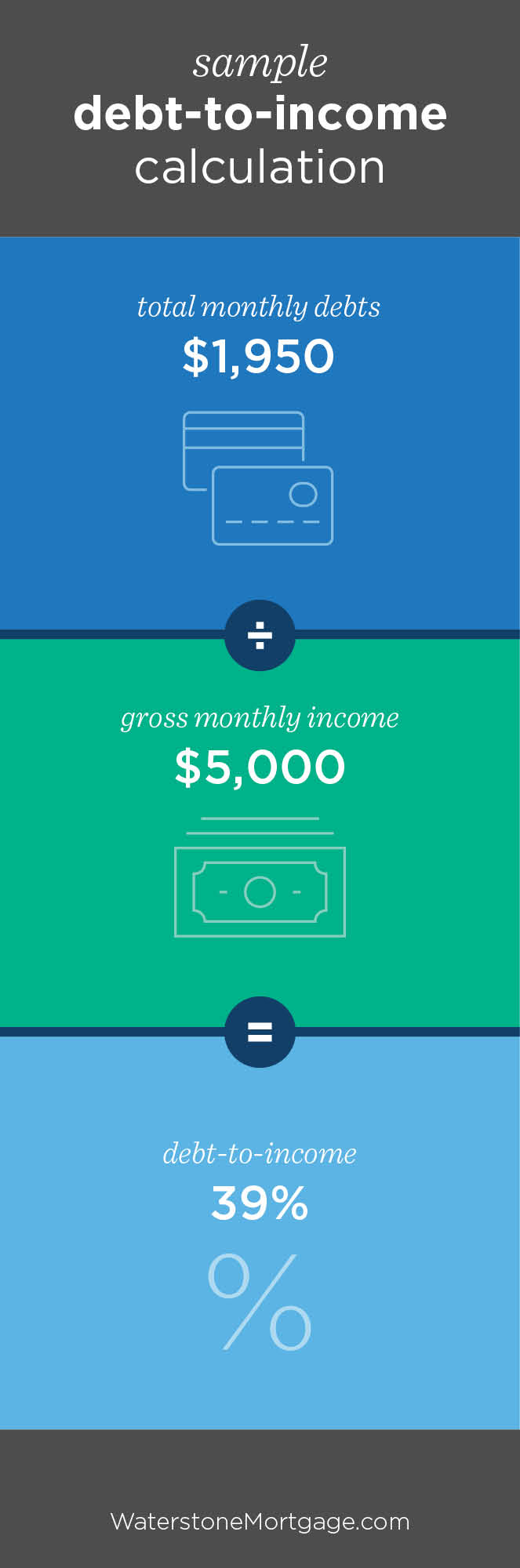

Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. The user will first calculate their monthly housing payment which consists of Principal and Interest.

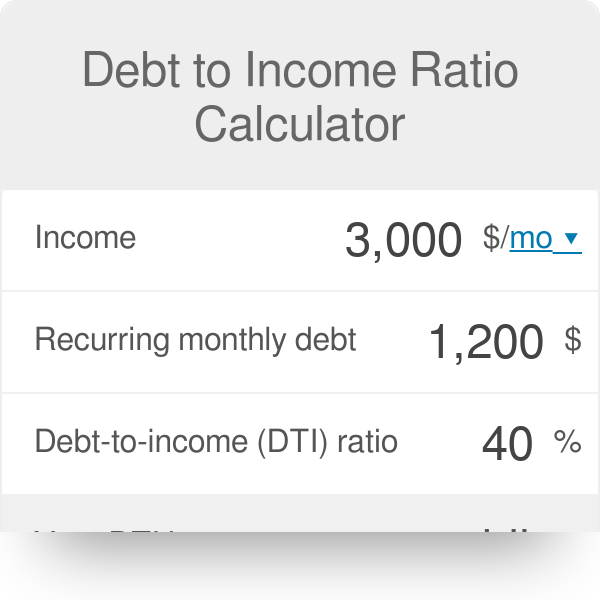

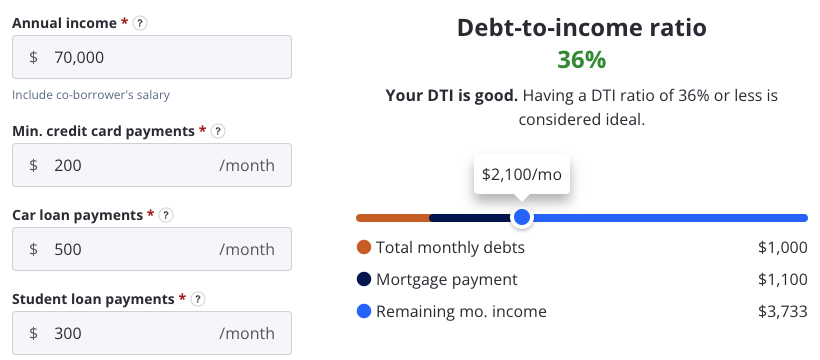

Web Your debt-to-income ratio or DTI is a calculation of your monthly debt payments divided by your gross monthly income. A good DTI ratio to get approved for a mortgage is under 36. Total monthly debt payments total gross monthly income Multiply this amount by 100 to convert it to a recognisable.

500 Monthly housing payment. Web Use our DTI calculator to find yours. Web If you have a salary of 72000 per year then your usable income for purposes of calculating DTI is 6000 per month.

Your DTI helps a mortgage lender determine. Web To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other. Lets take a look at how to calculate.

Web Use this calculator to compute your personal debt-to-income ratio a figure as important as your credit score which provides a snapshot of your overall financial health. 6000 Monthly recurring debts. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032.

Web Your debt-to-income ratio also determines whether youre eligible for the type of loan you want and improving your DTI can help you get lower mortgage rates. Web There is a two-part process for using the DTI mortgage calculator. DTI is always calculated on a monthly basis.

Multiply that by 100 to get a. Many lenders may even want to see a DTI thats closer to. Web Debt to income ratio DTI is calculated as the following.

A higher ratio could mean youll pay more interest or be denied. Ideally lenders prefer a debt-to-income ratio lower than. Web Your debt-to-income ratio or DTI is a percentage that tells lenders how much money you spend on monthly debt payments versus how much money you have coming.

Web While many lenders require a DTI of no more than 43 some lenders including Better Mortgage can provide mortgages to borrowers with DTIs up to 50. Web Calculating a 25 DTI Monthly Social Security Income taken at 125.

Debt To Income Ratio Calculator What Is My Dti Zillow

Home Affordability Calculator For Excel

How To Calculate Your Debt To Income Ratio Rocket Money

Debt To Income Ratio Calculator

How To Lower Your Dti Ratio

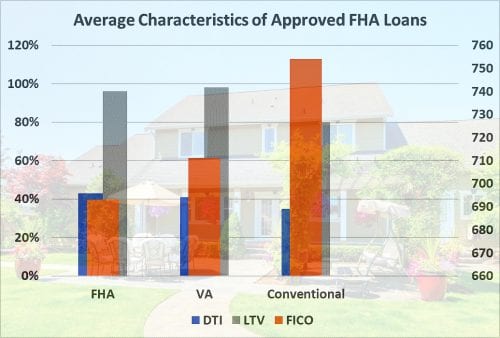

Fha Requirements Debt Guidelines

Fha Dti Ratio Requirements For Home Buyers What You Need To Know

Debt To Income Dti Calculator Interest Co Nz

How To Calculate Your Debt To Income Ratio

Great Advice On How To Get A Loan With A High Debt To Income Dti Ratio Moreira Team Mortgage

![]()

Dti Ratio Calculator On The App Store

What Is Debt To Income Ratio And Why Does Dti Matter Zillow

Guide To Fha Home Loans How Much Income Do You Need Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Debt To Income Ratio Dti Definition Calculation Formula

How To Calculate Your Debt To Income Ratio For A Mortgage

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

Here Are The Income Requirements For A Reverse Mortgage